Debate Prep: Northwestern’s Endowment

Coronavirus and its associated costs have been bad news for the university’s endowment. Northwestern started the year with an endowment valued around $10.8 billion, but it has decreased to about $10 billion as of the end of September, a decline of 7.4% of the total value. Consequently, the university has had to increase its endowment payout rate this year from 5.2% to 6%, which is the highest rate since at least 2004. (I did not check pre-2005 data.)

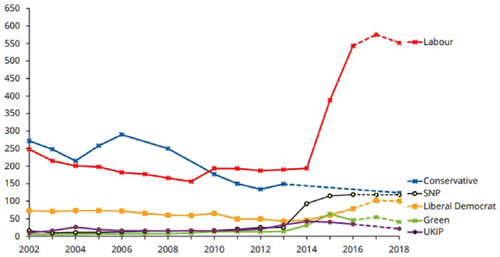

The endowment’s payout rate (red line) from 2010-2019

Spending Restrictions

While the endowment sounds like a singular entity, this is perhaps a misnomer. University endowments consist of thousands of funds established by individual donors, according to an expert surveyed by ABC News. When donors make these donations, they often intend them to be used for specific purposes—to use a prominent example, Mike Bloomberg gave $1.8 billion dollars to John Hopkins to be used for financial aid. Universities are legally bound to spend these donations only on their specified purposes. According to the Daily Northwestern, about 38% of the university’s 2019 net endowment assets were restricted by donors, with another 34% being designated for purposes like teaching, research and financial aid.

Liquidity

University endowments tend to have a great deal of long term investments in order to secure a better return rate on their investments. These assets are relatively illiquid and usually cannot be sold for cash at will. Some schools, for example, have invested in the timber industry and now own forests that cannot be sold at the drop of a hat. Universities, of course, have assets that are more liquid as well. Regarding our case, The Daily Northwestern estimates that the assets in Northwestern’s most liquid asset classes constitute 29% of the total endowment. These assets have notice periods of 1 to 180 days and can be redeemed daily to annually depending on the asset.

Should Northwestern Take Out More?

I will avoid writing too much about this question as the debaters tomorrow will answer this themselves, but I will highlight two perspectives on campus in this section. Notably, in May, President Schapiro said in response to calls to increase funding further that, “The idea that you can take money from the endowment and use it for whatever you want is sort of a fission. There’s no way in hell I would recommend to the board [that we] go above 6 percent.”

Meanwhile, the sentiment among labor activists on campus is that, even considering that some funds are restricted due to illiquidity, the university still has to be willing to raise the payout rate to protect employees like dining hall workers during this time. The Daily wrote in September, paraphrasing and quoting a Medill student, “At some point, [...] people start to look at the endowment and ask what is the point of having that much money if not to spend it on a ‘basic emergency response’ during a pandemic and recession.”